Leverage

Introduction to Leverage in Trading

Leverage is one of the most powerful tools in a trader’s toolkit. It allows you to control a larger position in the market with a relatively small amount of capital. This can dramatically increase your potential profits—but it also increases the risks. Whether you’re trading forex, stocks, or crypto, understanding how leverage works is essential to your success.

What is Leverage?

Leverage in trading refers to borrowing capital from your broker to increase the size of your position. It is expressed as a ratio, such as 10:1 or 100:1. This means that for every $1 of your own money, you can control $10 or $100 in the market, respectively.

Leverage vs. Margin

Leverage and margin are related concepts. Leverage is the ratio that describes how much you’re borrowing, while margin is the amount of money you need to put up to secure the position. For example, a 50:1 leverage ratio means you need just 2% of the trade value as margin.

How Leverage Works

Let’s say you have $1,000 in your trading account and use 50:1 leverage. You could open a position worth $50,000. If the price moves in your favor by 1%, your profit would be $500 (50% of your capital). But if it moves against you by 1%, you would also lose $500.

Benefits of Using Leverage

- Greater Market Exposure: Control larger positions without needing a lot of capital.

- Increased Potential Profits: Even small price movements can generate significant returns.

- Access to More Opportunities: Enables diversification across multiple trades with the same amount of money.

Risks of Using Leverage

- Amplified Losses: Just as leverage increases gains, it also increases losses.

- Margin Calls: If your losses exceed a certain amount, your broker may require you to add funds or close your position.

- Overconfidence: High leverage can give a false sense of security, leading to impulsive or oversized trades.

- Fast Account Depletion: A few wrong trades with high leverage can wipe out your account quickly.

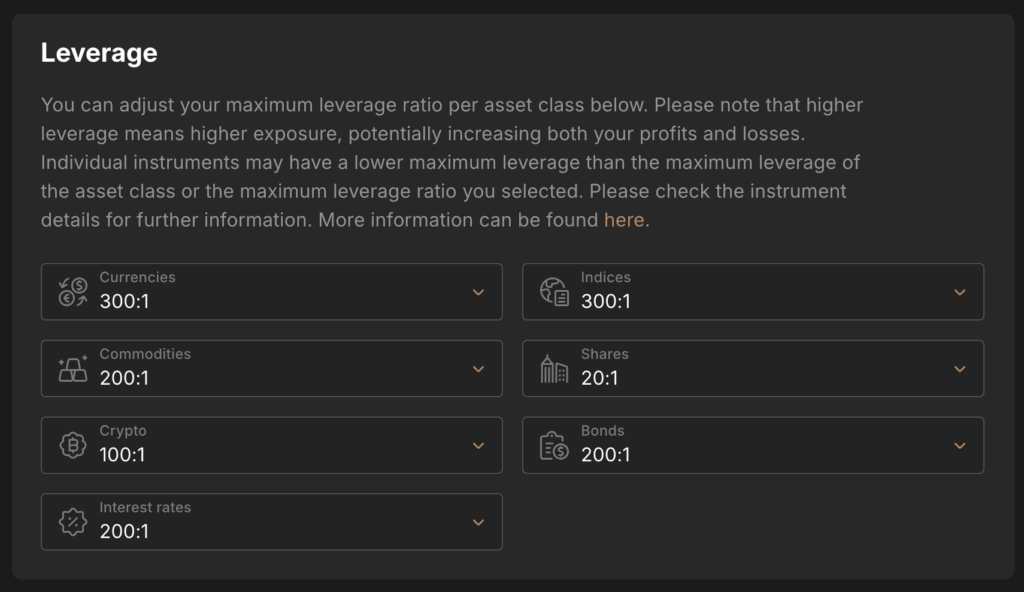

Common Leverage Ratios by Market

- Forex: Up to 50:1 (or even 100:1 in some regions)

- Stocks: Usually 2:1 for retail traders

- Cryptocurrency: Often ranges from 5:1 to 125:1 depending on the platform

- Commodities and Futures: Typically around 10:1 to 20:1

How to Manage Leverage Responsibly

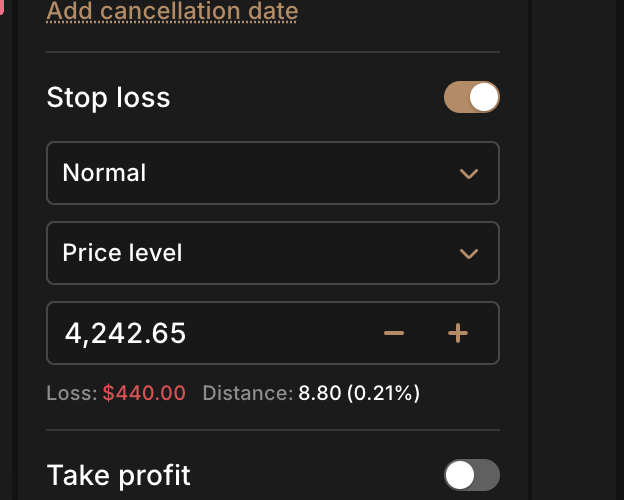

Use a Stop-Loss

A stop-loss order automatically closes your position if the price moves against you by a certain amount, helping you avoid large losses.

Start with Low Leverage

If you’re new to trading, avoid high leverage. Even professionals often use less than 5:1 leverage.

Never Risk More Than You Can Afford

Limit your exposure to a small percentage of your trading capital. A good rule is to risk no more than 1–2% per trade.

Monitor Your Positions

Stay alert, especially during high volatility. Leverage can magnify rapid market changes.

Conclusion

Leverage can be a powerful tool in trading, allowing you to amplify gains with less capital. But it’s a double-edged sword. Used without a clear risk management plan, it can lead to significant losses.

If you’re serious about trading, learn to respect leverage. Use it carefully, manage your risk, and always prioritize capital preservation over quick profits. With discipline and strategy, leverage can be your ally—not your downfall.