Margin

What is Margin in Trading?

Margin is one of those words that sounds complicated at first, but once you get it, the whole trading world suddenly makes more sense. In simple terms, margin is the amount of money a trader needs to open and maintain a trading position. It’s not a fee or a cost — it’s more like a deposit your broker holds to ensure you can cover potential losses on your trades.

When you trade with margin, you’re essentially borrowing funds from your broker to control a larger position than your actual account balance allows. For example, with a 1:100 leverage, you only need $100 to control a $10,000 trade. This means your potential profits can grow much faster — but so can your potential losses. That’s why understanding margin is crucial before jumping into leveraged trading.

Brokers calculate margin requirements based on the size of your trade and the leverage ratio. If your equity drops too low, you might face a margin call, where the broker asks you to add more funds to keep your position open. Ignoring this can result in automatic liquidation — your trades being closed to prevent further loss.

In short, margin is a powerful tool when used wisely. It allows traders to amplify opportunities, but it also increases risk. The best approach? Always treat margin like borrowed money — because it literally is. Keep your risk small, never over-leverage, and always have a solid risk management plan before entering the market.

How Margin Works

When you trade with margin, you’re essentially using borrowed money from your broker to open positions larger than your actual account balance. It’s like putting down a small deposit to gain access to a bigger trade. This deposit — known as margin — allows traders to amplify their buying power and potentially increase profits. However, it also means that losses can grow faster, so it’s important to understand how it really works before using it.

Here’s a simple example: if your broker offers 1:100 leverage, you can control a $10,000 trade with just $100 in margin. That $100 acts as collateral, ensuring you can cover potential losses. While your trade is active, the broker locks that amount. Once you close the trade, the margin is released back into your available balance, along with any profit or loss you’ve made.

As your trades fluctuate, your equity changes too. If your account balance drops too much, your broker may send a margin call — a request to deposit more money or close positions. If you don’t, your broker might automatically close trades to prevent your account from going negative. This is called a stop-out, and it’s designed to protect both you and the broker.

In short, margin gives traders the ability to do more with less, but it comes with responsibility. The key to using margin wisely is risk management — always knowing how much you can afford to lose, setting stop-loss orders, and avoiding over-leverage. Used correctly, margin can be a powerful tool; used carelessly, it can quickly wipe out your account.

Key Margin Terminology

Initial Margin

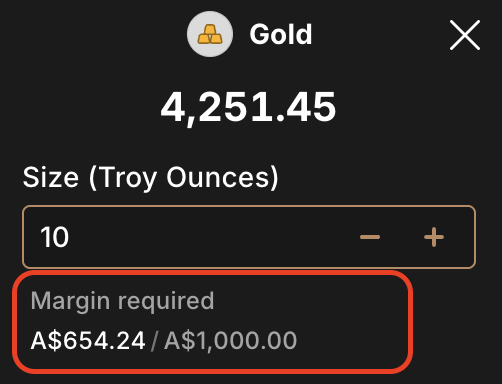

Initial margin is the amount of money you need to deposit before opening a leveraged trade. Think of it as a security deposit — a small percentage of the total trade value that shows your broker you can cover potential losses. Without this upfront amount, you can’t open a position, because the broker needs assurance that you have some “skin in the game.” The size of the initial margin depends on factors like the asset you’re trading, the leverage you choose, and the broker’s risk policies.

For example, if you’re trading with 1:50 leverage, you’ll need to provide just 2% of the total trade size as your initial margin. That means for a $10,000 position, you only need $200 to open it. The broker lends you the rest, effectively multiplying your market exposure. This setup allows traders with smaller accounts to access larger opportunities, but it also increases the risk of rapid losses if the market moves in the wrong direction.

Your initial margin remains locked while your position is active. If your trade moves against you and your account’s equity falls too low, you may receive a margin call — a warning to add more funds or close positions to maintain your margin level. If you fail to do so, your broker might automatically close the trade to prevent further losses.

In simple terms, initial margin is your ticket into the world of leveraged trading. It’s a small commitment that unlocks larger possibilities, but it also demands responsibility. Always calculate your position size carefully, understand the leverage you’re using, and never risk more than you can afford to lose. Proper control over your initial margin is what separates smart traders from reckless ones.

Maintenance Margin

Maintenance margin is the minimum amount of equity you must keep in your trading account to keep your open positions active. It acts like a safety net between you and your broker, ensuring there’s always enough balance to cover potential losses. If your account equity drops below this level because the market moves against you, your broker will issue a margin call, asking you to add more funds or close some trades.

This concept is crucial in leveraged trading. For instance, imagine you opened a $10,000 position with $500 of your own money. If your losses reduce your account balance too much, and your equity falls below the maintenance margin — say $250 — the broker steps in to protect both sides. They’ll either request a deposit or automatically close your trades to stop further losses, a process known as liquidation or stop-out.

In simple terms, the maintenance margin keeps your trading account from going negative. It’s like a warning light on your dashboard — once it flashes, you know it’s time to act fast. Responsible traders always monitor their margin level, use stop-losses, and avoid over-leveraging to stay above the threshold. The goal isn’t just to open big trades but to keep them safely open for as long as your strategy requires.

Margin Call

A margin call happens when your trading account no longer has enough equity to support your open positions. It’s basically your broker’s way of saying, “Hey, you’re running out of money — add more funds or close some trades.” This usually occurs when the market moves against your position and your account value drops below the required maintenance margin.

When a margin call is triggered, you have two options: deposit more money into your account or close part of your open positions to free up margin. If you ignore the call, your broker may automatically close trades to prevent your account from going negative — a process known as forced liquidation or stop-out. This is done to protect both you and the broker from deeper losses.

Margin calls are a common experience for new traders who over-leverage or trade without a solid risk management plan. The best way to avoid them is by keeping enough free margin, setting appropriate stop-losses, and never risking more than a small percentage of your balance on a single trade. In short, a margin call isn’t the end of your trading journey — it’s a wake-up call to manage your risk smarter.

Leverage

Leverage is one of the most powerful — and risky — tools in trading. It allows you to control a much larger position than your actual account balance. In simple terms, leverage means borrowing funds from your broker to amplify your market exposure. For example, with 1:100 leverage, you can open a $10,000 position using just $100 of your own money. While this can boost your potential profits, it also means losses can grow just as quickly.

The main advantage of leverage is accessibility. It enables small traders to participate in big markets like forex, gold, or indices without needing huge capital. However, many beginners misuse it, opening oversized trades that wipe out their accounts with only small price movements. That’s why experienced traders always emphasize risk management — using lower leverage and smaller position sizes to protect capital.

In practice, leverage can be your best friend or your worst enemy. Used wisely, it helps you make the most of your trading opportunities; used carelessly, it can drain your account in minutes. Always think of leverage as a sharp tool — effective only when handled with precision and respect.

Why Traders Use Margin

Increased Buying Power

Traders use margin because it gives them the ability to control larger positions with a smaller amount of capital. This concept, known as increased buying power, allows a trader with, say, $1,000 to open trades worth $50,000 or even $100,000 depending on the leverage offered by their broker. By borrowing funds temporarily, traders can take advantage of small market movements and potentially earn higher profits than they could with their own money alone.

However, this extra buying power comes with responsibility. The same leverage that multiplies profits can also magnify losses if the market moves in the wrong direction. That’s why professional traders use margin strategically — they calculate risk carefully, set stop-losses, and never overexpose their accounts. Margin isn’t free money; it’s a tool that demands discipline and understanding.

In essence, traders use margin to make their capital more efficient. It lets them diversify trades, seize more opportunities, and optimize returns without needing a massive account balance. But the smartest traders always remember the golden rule: treat margin like borrowed money — because it is — and manage it with care.

Potential for Higher Profits

One of the biggest reasons traders use margin is the potential for higher profits. By borrowing money from their broker, traders can control positions much larger than their actual account size. This means even small price movements in the market can lead to significant gains. For instance, with 1:100 leverage, a trader can turn a 1% move in their favor into a 100% profit on their initial margin. It’s this multiplier effect that makes margin trading so attractive to active traders.

But while the upside is tempting, the same mechanism that boosts profits can also magnify losses. If the market moves against you, losses are calculated on the full trade size, not just your margin deposit. This is why experienced traders always combine leverage with strong risk management strategies — like using stop-loss orders and limiting risk per trade to a small percentage of their capital.

Ultimately, margin trading isn’t just about chasing bigger profits; it’s about using capital efficiently. When handled with discipline, it can help traders maximize returns from short-term opportunities without needing massive investment. The key is balance — knowing when to use leverage for growth and when to step back to protect your capital.

More Flexibility

Margin trading offers traders more flexibility by allowing them to open and manage multiple positions without needing a large amount of capital. Instead of locking up all their money in a single trade, they can spread their funds across different assets — like forex pairs, gold, or indices — and take advantage of several opportunities at once. This flexibility helps traders diversify their strategies and react quickly to changing market conditions.

For example, with margin, a trader can keep some funds free for new setups while maintaining open trades elsewhere. It also allows traders to hedge their positions — opening trades in opposite directions to balance risk. This kind of freedom isn’t possible when trading with only your own cash balance, making margin a valuable tool for active and strategic traders.

However, this flexibility requires discipline. Having the ability to open many trades doesn’t mean you should. It’s easy to overextend and take on too much risk, which can lead to margin calls or forced liquidations. The best traders use margin not to gamble, but to stay agile — entering and exiting trades smartly, managing exposure, and keeping their strategies adaptable in fast-moving markets.

The Risks of Margin Trading

Amplified Losses

Just as gains are magnified, so are losses. A small adverse movement in price can wipe out your account if proper risk management is not in place.

Emotional Pressure

Larger positions can cause more stress and lead to emotional decisions, which often result in poor trading outcomes.

Margin Calls and Liquidation

If your equity falls too low, you may receive a margin call. If ignored, your broker can close your trades automatically.

Interest Costs

Some brokers charge interest on borrowed funds, which can reduce profitability over time.

How to Manage Margin Effectively

Use Stop-Loss Orders

Always set stop-loss levels to limit your downside on each trade.

Start with Low Leverage

If you’re new to trading, avoid using high leverage until you gain experience.

Monitor Your Margin Level

Regularly check your account to ensure you have enough equity to avoid margin calls.

Avoid Overtrading

Don’t open multiple large positions at once. Manage your capital wisely.

Use a Risk Management Plan

Never risk more than a small percentage of your account on a single trade.

Conclusion

Margin trading opens the door to bigger opportunities, faster profits, and greater flexibility — but it also demands respect and control. By using borrowed funds, traders can access larger positions and diversify their strategies, even with smaller accounts. However, this power comes with risk: leverage can multiply gains just as easily as it multiplies losses.

Successful traders understand that margin isn’t free money — it’s a tool that rewards discipline. They monitor their equity, manage risk carefully, and avoid over-leveraging. In the end, the goal isn’t just to trade big, but to trade smart. When used wisely, margin becomes more than a borrowing mechanism; it becomes a way to grow consistently while keeping your capital safe.